How To Avoid Common Problems When DevelopingAML/CTF Risk Assessments

Australia’s AML/CTF Tranche 2 reforms will push many newly regulated businesses into a world of compliance obligations, including formalising risk governance, evidence-based reporting, and audit-ready documentation. Below is a structured look at why that matters and how a purpose-built platform helps.

ML/TF Compliance Reporting Starts with Firm-Wide Risks

For Tranche 2 entities, ML/TF compliance reporting is only as strong as the risk logic beneath it. Regulators and auditors typically want to see:

-

Methodology

A clear methodology for identifying and rating ML/TF risks must be logical and demonstrated.

-

Controls

AML/CTF risk assessments must adequately inform the AML/CTF Program and align policies, procedures and controls to mitigate the risks.

-

Reporting

Traceable decisions (who approved what, when, and why). Your firm must demonstrate governance systems for ongoing monitoring and reporting.

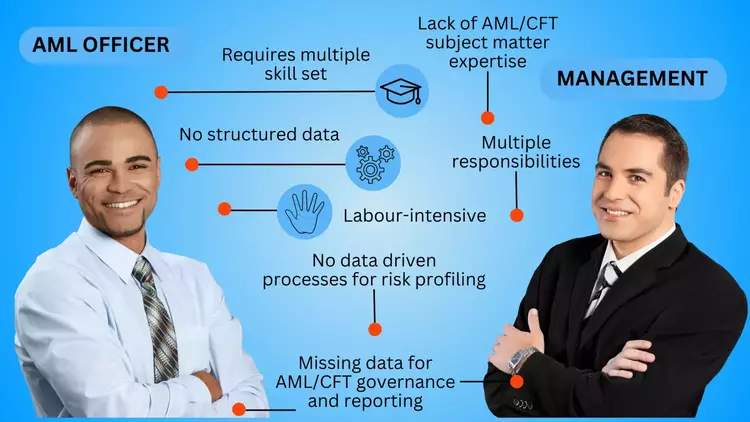

How Does RegTech Support AML/CTF Risk Assessments?

A strong ML/TF RegTech platform can turn that workload from “spreadsheet panic” into a repeatable operating rhythm—and that’s where AML360™ regulatory technology (RegTech) can be a smart choice.

AML360™ is well-suited to businesses that want their AML/CTF Risk Assessments as a living system—where risk drivers, control mappings, and review cycles operate like a well-oiled engine. No struggling, no breakdowns and no starting and stopping.

AML360™ is a defensible reporting solution that adapts to regulatory updates and recommendations from independent ML/TF findings.

For Australia’s AML/CTF Tranche 2 entities, the compliance reporting burden isn’t just about producing documents—it’s about demonstrating a coherent, repeatable risk management system. AML360™ regulatory technology stands out as a strong option because it helps turn AML/CTF Risk Assessments into a maintained operational asset: consistent, reviewable, and reporting-ready across the business.

🔍 Why AML360™?

1) It helps you operationalise AML/CTF Risk Assessments end-to-end

A common Tranche 2 failure mode is having a one-off assessment document that doesn’t connect to ongoing reporting.

2) It supports consistency across teams, sites, and service lines

Tranche 2 businesses often have multiple service offerings and delivery models. The AML360™ RegTech platform helps to apply a single assessment approach across the organisation and reduce the “version chaos” from paper-type risk reporting. AML360™ presents a defensible risk-based approach for rating rationales and ML/TF compliance language.

That professional consistency makes business risk compliance reporting far easier to produce—and far easier to explain.

3) Stronger governance, clearer accountability

Regulators care about governance as much as outputs. A platform approach typically strengthens: (a) Ownership of risks and controls, (b) Review and approval workflows, (c) Audit trails and evidence retention.

When your AML/CTF Risk Assessments are tied to structured approvals and review dates, reporting becomes more than narrative—it becomes provable.

4) Better reporting for management and boards

Boards and senior leaders don’t want a compliance “data dump.” They want risk direction, control effectiveness, and exceptions.

AML360™ can be effective for producing reporting views from reliable underlying assessment data—helping you firm to explain inherent/residual risks and what’s driving them. This enables your business to demonstrate an alignment of controls to your AML/CTF Program.

These ongoing compliance processes can be streamlined when AML/CTF Risk Assessments are maintained in a structured, reviewable format.

5) Faster updates when the business changes

Tranche 2 entities may be scaling, launching services, onboarding new customer segments, or expanding digitally. Each change can trigger reassessment and reporting updates.

The AML360™ RegTech approach reduces the friction of:

(a) Re-scoping risk modules;

(b) Updating control mappings;

(c) Compliance reporting with clear context.